Introduction

Solana is a high-performance blockchain, leveraging Proof of Stake (PoS) and Proof of History (PoH) to process up to 65,000 transactions per second at low costs. This makes it ideal for decentralized applications (dApps) and decentralized finance (DeFi). Staking on Solana supports network security while earning rewards, and liquid staking tokens (LSTs) keep assets liquid for DeFi opportunities.

StrongSOL, from Stronghold Solana Validator, is a top Solana LST, offering an advertised 18.56% APY as of 11:44 AM BST on July 6, 2025. A partnership with Kamino, announced on June 18, 2025, introduces 50strongSOL monthly incentives—a limited-time Solana LST offer ending July 18, 2025, with the next month’s details to be announced (TBA). Act now to seize this opportunity! This guide shows how to stake Solana LST with strongSOL and maximize returns.

What is a Solana LST?

A Solana liquid staking token (LST) represents staked SOL tokens, allowing you to engage in DeFi activities like lending or trading while earning rewards. Unlike traditional staking, which locks your SOL, LSTs like strongSOL offer flexibility to use your assets. This positions strongSOL as a leading Solana LST with an attractive APY, ideal for those seeking the best Solana LST 2025.

How strongSOL Works as a Solana LST

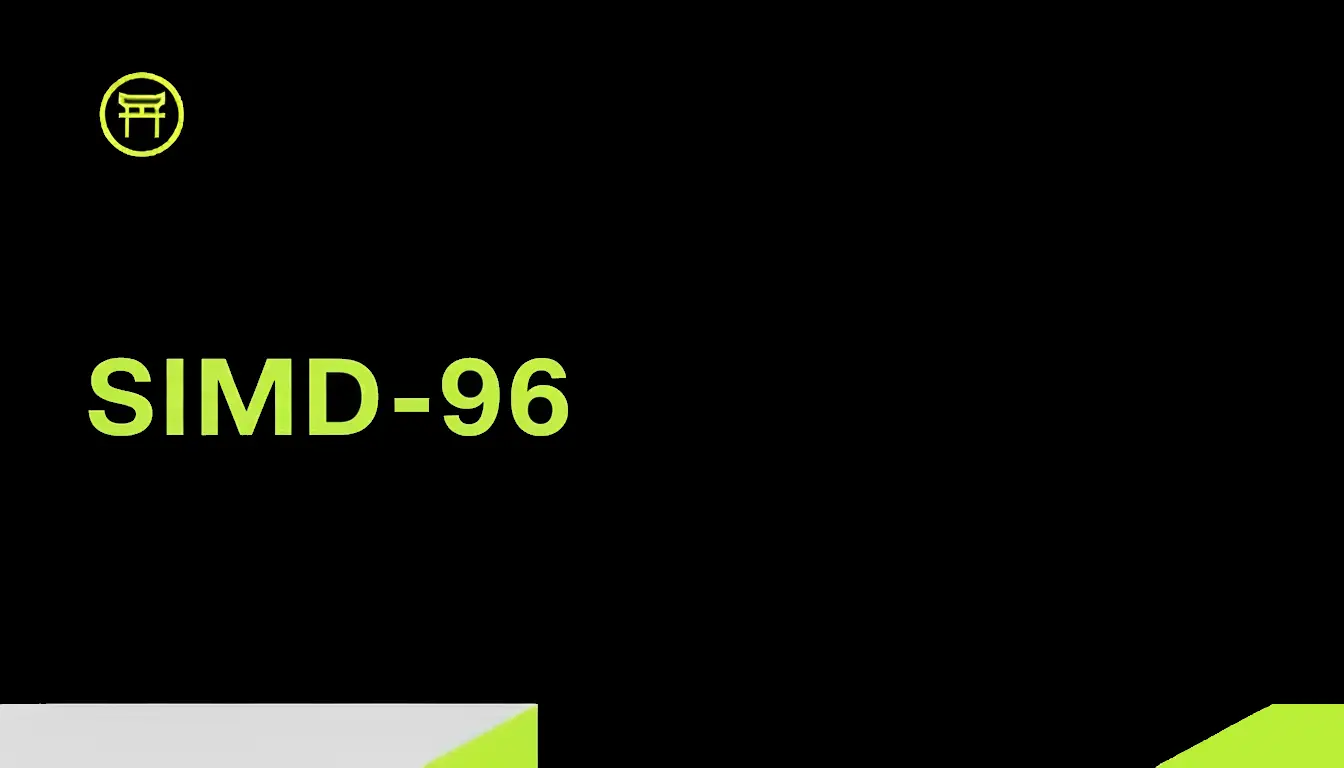

StrongSOL is created when you stake SOL through Stronghold, turning your investment into a versatile token. You can hold strongSOL to earn rewards every epoch (about 2–3 days), use it in DeFi for lending or trading, or redeem it for SOL after a deactivation period. This flexibility makes strongSOL a practical Solana LST. The process is illustrated below:

Figure 1: Staking Process for strongSOL

Benefits of Using strongSOL as Your Solana LST

strongSOL offers compelling advantages in the Solana ecosystem. It delivers an advertised 18.56% APY as of July 6, 2025, boosted by a limited-time Solana LST offer of 50strongSOL monthly incentives, expiring July 18, 2025, with the next month TBA—urging swift action. Moreover, strongSOL provides passive income as rewards accrue, supports DeFi flexibility on platforms like Jupiter, RainFi, Sanctum, and Kamino, and strengthens Solana’s decentralization through Stronghold’s staking. With Stronghold’s 99.9% uptime and Solana Foundation approval, reliability is ensured. Additionally, Jito MEV and Kamino’s Multiply product maximize yields. Don’t miss this limited-time Solana LST offer!

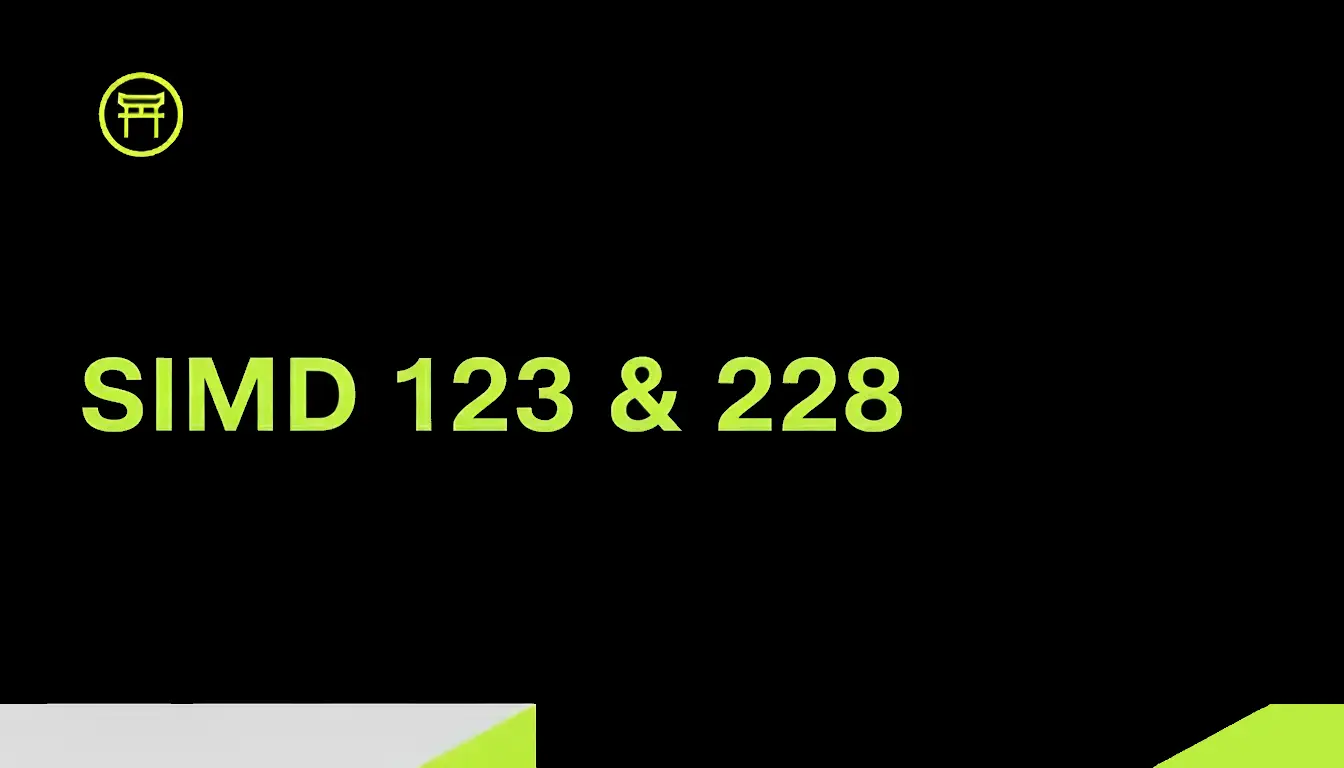

Getting Started with StrongSOL: Stake in Minutes

Starting with strongSOL is straightforward—act now to secure the 50strongSOL offer before July 18, 2025. Set up your wallet in minutes using Phantom or Sollet, then acquire SOL tokens via Coinbase or Binance. Stake your SOL at https://strongholdsol.com or Sanctum, requiring just 0.00228 SOL. You’ll receive strongSOL to hold for rewards or use in DeFi. Monitor epoch-based rewards as they grow. Activation and deactivation take 2–3 epochs (2–3 days). See the “Staking Process Overview” below for a visual guide. Learn how to stake Solana LST with strongSOL today!

Figure 2: Staking Process Overview

Maximizing Your Solana LST with Kamino’s Multiply

Multiply Features

The Stronghold-Kamino partnership boosts strongSOL’s 18.56% APY. The 50strongSOL incentives, a limited-time Solana LST offer, end on July 18, 2025, with the next month TBA. Announced on June 18, 2025, via a tweet from Stronghold: “strongSOL is live on Kamino Lend! You can now deposit $strongSOL into lending or use strongSOL Multiply. Lever up your yield to increase your APY! For the upcoming month, depositors will be earning 50 strongSOL!” (see image below).

Figure 3: Kamino Incentives Tweet

Kamino’s Multiply is a one-click vault, enhancing strongSOL’s yield through lending and looping strategies, secured by K-Lend’s eMode and kToken collateral. The 50strongSOL incentives add value until July 18. Stake now to claim 50strongSOL!

Getting Started with Multiply

- Connect Your Wallet: Visit https://app.kamino.finance and connect a Solana wallet like Phantom or Sollet.

- Navigate to Multiply: Find the Multiply section on Kamino’s platform, typically under lending or yield options.

- Select strongSOL Vault: Choose the strongSOL Multiply vault from the list of available assets.

- Deposit strongSOL: Enter the amount of strongSOL to deposit. Kamino automatically leverages your position using flash loans (0.001% fee).

- Set Leverage Level: Adjust leverage based on your risk tolerance (up to 10x with 90% LTV).

- Monitor Your Position: Track APY, borrow rate, and liquidation risk.

- Manage or Withdraw: Adjust leverage or withdraw via Kamino. Note applicable fees and slippage.

Understanding Multiply with strongSOL

Multiply leverages strongSOL by borrowing SOL to increase exposure, using eMode for higher loan-to-value ratios (up to 90% for strongSOL/SOL) and flash loans for seamless looping. Yields come from strongSOL’s staking rewards and kToken market-making (e.g., kstrongSOL-SOL). For example, with 1000 SOL at 8x leverage, you could have 8000 SOL exposure (7000 SOL debt), potentially yielding 14% net APY. Risks include liquidation from sustained high borrow rates or smart contract issues. This makes Multiply a powerful tool for boosting returns, especially with the 50strongSOL offer.

Using StrongSOL in DeFi

strongSOL’s liquidity unlocks Solana’s DeFi ecosystem. Trade it on Jupiter with DCA, Swap, or Limit Orders. Access real-time price data on Switchboard, lend with RainFi, enhance liquidity via Sanctum, or maximize yields with Jito MEV. These platforms make strongSOL a versatile asset for growth.

StrongSOL’s Edge Among Solana LSTs

Future of strongSOL

strongSOL stands out with its limited-time Solana LST offer of 50strongSOL incentives, ending July 18, 2025, with the next month TBA. Backed by Stronghold, a Solana Foundation-approved validator with 99.9% uptime, it integrates with major DeFi platforms. Its audited SPL stake pool program manages over $1B in assets. With the Kamino partnership, yields are expected to grow—positioning strongSOL as the best Solana LST 2025.

Security and Trust

strongSOL prioritizes security. Stronghold’s Solana Foundation Delegation Program membership ensures quality. Its infrastructure has passed nine audits without exploit, delivering a trustworthy staking experience with 99.9% uptime.

FAQ

- What is the minimum SOL required to stake with Stronghold? A minimum of 0.00228 SOL is needed.

- How long does activation/deactivation take? About 2–3 epochs, or 2–3 days.

- Is strongSOL safe? Yes, built on the audited SPL stake pool program.

- Why does strongSOL have a 18.56% APY? It includes Jito MEV yield and the limited-time Solana LST offer of 50strongSOL.

- How long is the 50strongSOL offer available? Until July 18, 2025. Next month TBA.

- How to use Kamino’s Multiply? Visit Kamino, connect, and deposit strongSOL.

Conclusion

strongSOL is a top Solana LST, delivering an advertised 18.56% APY as of July 6, 2025, and a limited-time Solana LST offer of 50strongSOL ending July 18, 2025, with the next month TBA. Enhanced by Kamino’s Multiply, it blends staking rewards with DeFi flexibility. Visit strongholdsol.com to stake and app.kamino.finance to claim this offer. Learn how to stake Solana LST with strongSOL today!